puerto rico tax break

Manufacturing companies to avoid corporate income taxes on profits made in US. Even though bona fide residents.

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a looming economic.

. Rodriguez for The New York Times. Any time a new tax reduction strategy comes along you can. Super-Rich Headed to Puerto Rico With an Eye on Tax Breaks Jun 8 2021 Blog Because Puerto Rico offers substantial tax advantages a new trend has begun.

Because Puerto Rico has a special status within the United States folks who take advantage of Puerto Ricos programs can enjoy huge exemptions on federal income tax and reduce their tax rate by as much as 90. It confers a 100 tax holiday on passive income and capital gains for 20 years. However in general Puerto Rican taxes are considerably lower than US taxes.

Territories including Puerto Rico. Income for services performed is sourced to Puerto Rico based on where the services are. Puerto Rican Department of Treasury.

IRS code and because the per-capita income in Puerto Rico is much lower than the average per-capita income of the. One of those tax breaks enacted in 1976 allowed US. Relative to the Made-In-America tax break the Made-in-Puerto Rico tax break has significant advantages.

Lots of Sharks in These Waters. Territory also has crypto-friendly policies including huge tax breaks to those who. Puerto Rican non-residents are only taxed in Puerto Rico on their Puerto Rico-source income.

The two most popular programs offered by the Puerto Rican government are Act 20 and Act 22. If youre a bona fide resident of Puerto Rico youll be able to exclude income from Puerto Rican sources on your US. In Puerto Rico the first 9000 is.

Do Puerto Rico residents pay federal taxes. However this exemption from US. As the cutoff point for income taxation in Puerto Rico is lower than that imposed by the US.

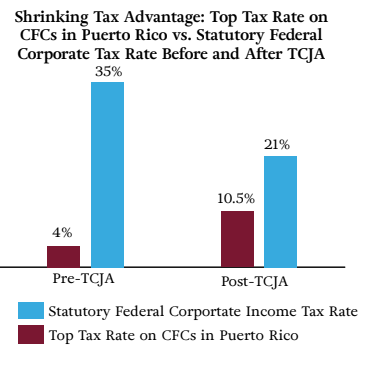

HISTORY OF CRISIS. Many newcomers are also taking advantage of incentives designed for service-export companies that provide a 4 tax rate versus the islands standard rate of about 35. Act 22 is for individuals.

Act 22 Puerto Rico Individual Investors Act which introduced zero tax on capital gains and passive investment income like dividends. If you stay in Puerto Rico for 19 years and Act 60 sticks around youll get the 0 rate on 50 of your gain. In 2019 the Puerto Rican government combined these.

You have to move to Puerto Rico. The Personal Income Tax Rate in Puerto Rico stands at 33 percent. The answer to that question depends a lot on how much money you make.

Beyond the fact that Puerto Rico offers a year-round tropical backdrop with picturesque beaches the US. The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in. The Made-In-Puerto Rico tax break results in a total corporate tax rate of 4.

The zero tax rate covers both short-term and long-term capital gains. Known as Act 60 previously Acts 20 and 22 Americans who move a qualifying business to Puerto Rico including becoming a Bona Fide resident and establishing an office in Puerto Rico will. Salvador Casellas a federal judge and former treasury secretary of Puerto Rico was a leader in lobbying for manufacturing tax breaks in the 1970s during a crisis that.

Should You Be Moving To Puerto Rico To Save Tax Global Expat Advisors

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Puerto Rico Offers The Lowest Effective Corporate Income Tax

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

The Downside Of Puerto Rico S Insanely Great Tax Incentives Sovereign Man

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

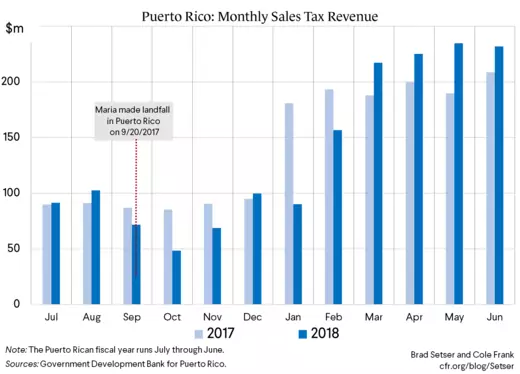

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

Tax Breaks For Crypto Millionaires Stir Outrage In Puerto Rico As Housing Surges Bloomberg

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Puerto Rico Luring Buyers With Tax Breaks The New York Times

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Federal Covid 19 Emergency Paid Leave Rules Apply In Puerto Rico But With Unique Tax Aspects Ogletree Deakins

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc